florida estate tax exemption

The first 25000 of the exemption applies to all taxing authorities. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Relocating To Florida Understanding Estate Taxes On Your Property The Lynch Law Group Llc Attorneys In Cranberry Twp And Pittsburgh

If you are a new Florida resident or you did not.

. For the first 50000 in assessed value of your home up to 25000 in value is exempted. Federal Estate Tax. Any real estate owned and used as a homestead by a veteran who was honorably discharged and has been certified as having a service-connected permanent and total disability is exempt from taxation of the veteran is a permanent resident of Florida and has legal title to the property on January 1 of the tax year for which.

Blind Person ExemptionsA 500 tax reduction for persons who are legally blind. Eligibility for property tax exemptions depends on certain requirements. However federal IRS laws require an estate tax.

Owns real estate with a just value less than 250000. The first 25000 in property value is exempt from all property taxes including school district taxes. Ad Valorem Tax Exemption.

Property owners in Florida may be eligible for exemptions and additional benefits that can reduce their property tax liability. Florida does not collect an estate tax. Estate Tax Exemption Maximum Rate on Estate Greater Than Exemption.

Most Realtors know about the 50000 standard homestead exemption but did you know that there are around two dozen other exemptions. State law specifically mentions blindness use of a wheelchair for mobility and other partial and total disabilities as qualifying conditions for this exemption. The above exemption applies to all.

Available in certain cities and counties only this exemption offers up to a 50000 reduction in property value assessment if certain income criteria are met. Property taxes apply to both homes and businesses. Information is available from the property appraisers office in the county where.

Unified Estate Tax and Gift Tax Exemption. What is the Florida property tax or real estate tax. If you have disabilities you may qualify for a 500 property tax deduction.

The homestead exemption and Save Our Homes assessment limitation help thousands of Florida homeowners save money on their property taxes every year. Florida property owners have to pay property taxes each year based on the value of their property. The size of the estate tax exemption meant that a mere 01 of.

Senior Citizen ExemptionsAs much as 50000 for people who are 65 years old or older and live in Florida with an income below 20000. 25000 of value is exempt from non-school taxes and the remaining 10000 of value is taxable. Sales tax exemption certificates expire after five years.

The Department reviews each exemption certificate sixty 60 days before the current certificate expires. As a service to our clients and followers Sunny Associates has put together a list. With the Florida homestead exemption you can reduce the taxable value of your home by as much as 50000.

To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40. Total and Permanent Disability ExemptionsHomeowners who are totally disabled may be exempt from all property taxes. An additional 25000 exemption that excludes school taxes if your assessed value is more than 50000.

Sales and Use Tax. For example if a person makes taxable gifts totalling 2 million during his lifetime he will have 97M estate tax exemption left over that may be passed at death 117M. This exemption is in addition to the homestead exemption.

Assessed Value 85000 The first 25000 of value is exempt from all property tax the next 25000 of value is taxable the third. Florida Property Tax Valuation and Income Limitation Rates see s. The homestead tax exemption in Florida can result in significant property tax savings.

The next 25000 in value 25000-50000 is. Florida Homestead exemption up to 50000. Florida law provides for lower property tax assessments on homestead property.

No Florida estate tax is due for decedents who died on or after January 1 2005. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Get Access to the Largest Online Library of Legal Forms for Any State.

If your property qualifies for the exemption you can have 50000 of your propertys first 75000 in value exempted from your taxes. The additional 25000 exemption is available for non. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

For those governmental entities located outside Florida. Specifically the first 25000 in value is exempt from property taxes. 500 exemptions are available to blind Florida residents.

Floridas freedom from state estate tax and its lack of a state income tax are incentives for people to. 15000 of value is exempt from non-school taxes. Property Tax Exemptions Available in Florida for People with Disabilities.

Its offered based on your homes assessed value and provides exemptions within a certain value limit. Fifteen states levy an estate tax. Florida Real Estate Tax Exemptions What You Need To Know.

If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida Form DR-312 to release the Florida estate tax lien. Download Or Email Form DR-312 More Fillable Forms Register and Subscribe Now. The estate tax exemption is adjusted for inflation every year.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. Ad From Fisher Investments 40 years managing money and helping thousands of families. The average property tax rate in.

Form 4768 Application for Extension of Time to File a Return andor Pay US. Taxable gifts are deducted from lifetime estate tax exemption. 2022 Annual Gift Tax.

The Form 706-NA United States Estate and Generation-Skipping Transfer Tax Return Estate of nonresident not a citizen of the United States if required must be filed within 9 months after the date of death unless an extension of time to file was granted. The federal estate tax exemption for 2022 is 1206 million. However if the current federal tax laws remain in place the exemption amount will be decreased by 50 in 2026.

Under the Florida Constitution every Florida homeowner can receive a homestead exemption up to 50000. When a Florida governmental entity remains in effect a new exemption certificate will be mailed to the governmental entity. Avail tax planning services from professional Florida Tax Planning Attorneys to save taxes and build wealth.

Given that Florida has around a 2 average tax rate that means a homeowner with 500000 in portability will see a tax bill about 10000 a year lower than it would be without it.

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

List Of 14 Commonly Overlooked Personal Tax Deductions Credits For Individuals Estate Tax Inheritance Tax Tax Preparation

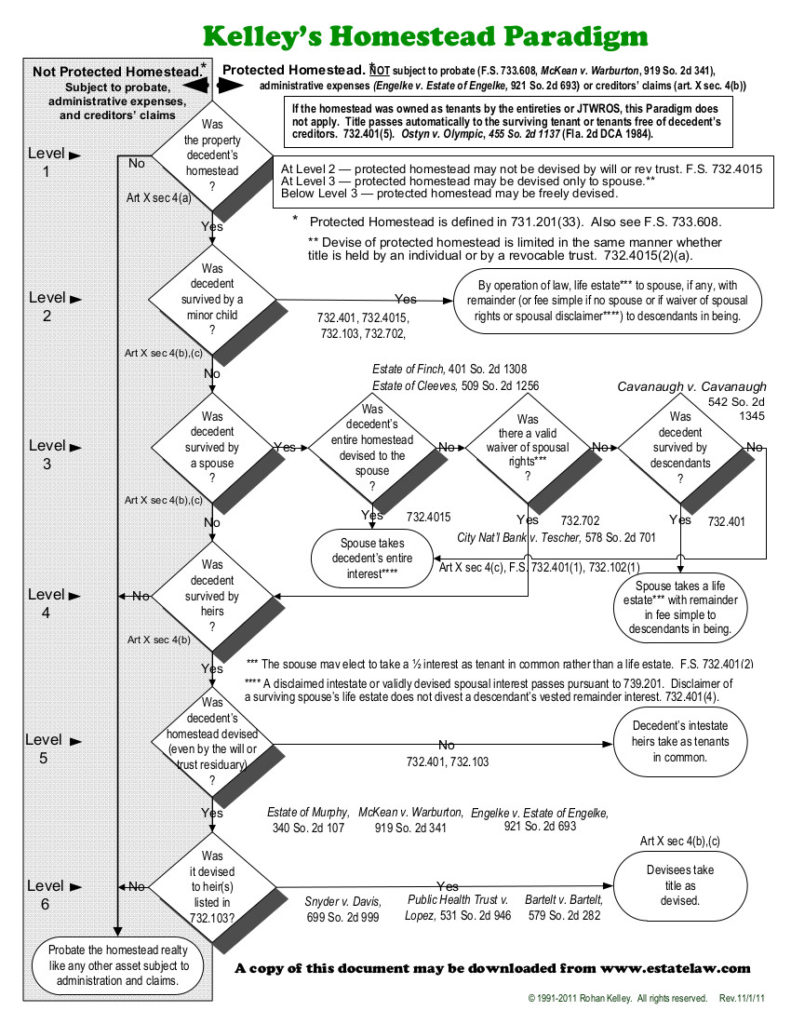

Florida Homestead Advantages Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Homestead Exemption How It Works Kin Insurance

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Federal Estate Tax Facts You Should Know So You Can Pass As Much Tax Free Money As Possible To Loved Ones Karp Law Firm

Florida Homestead Without A Will Alper Law

Homestead Exemption Attorney Miami Martindale Com

Florida Estate Planning Guide Everything You Need To Know

Florida Attorney For Federal Estate Taxes Karp Law Firm

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Does Florida Have An Inheritance Tax Alper Law

Recent Changes To Estate Tax Law What S New For 2019

Will My Florida Estate Be Taxed Nici Law Firm P L Naples Fl

Florida Estate Tax Rules On Estate Inheritance Taxes

Florida Property Tax H R Block

What You Need To Know About Estate Tax In Florida St Petersburg Estate Planning Lawyers

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller