waterbury ct taxes owed

As owners of property taxpayers are responsible to know when their taxes are due. Box 2216 Waterbury CT 06722-2216.

The 10 Best Home Remodeling Contractors In Waterbury Ct 2022

Please contact provider for fee information.

. Tax Attorney serving Waterbury CT. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner. Same Day Tax Consultation.

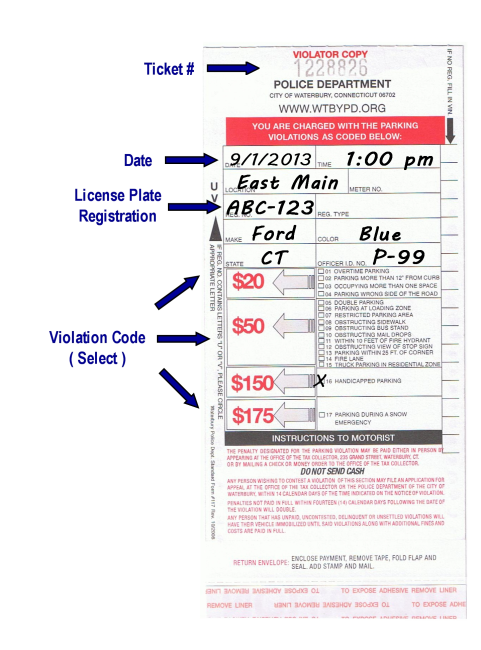

Pay Your Parking Ticket Pay Your Car Real Estate and Property Taxes. Page 1 of 1 Mill Rates A mill rate is the rate thats used to calculate your property tax. Department of Revenue Services.

CT - New Haven County - Waterbury Fees. Setup email alerts today Click Here. City Of Waterbury CT.

Be the first to know about new foreclosures in an area. Waterbury Ct 06708 currently has 44 tax liens available as of August 9. The relatively high interest rates on these.

See IP 20193 Q A on the Connecticut Individual Use Tax. If you have delinquent motor vehicle taxes please be aware that DMV clearances are now only done electronically. Call or visit website for.

Check the tax bill inquiry system. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in. Call or visit website for. Properties By Sale Date Currently selected.

Account info last updated on Oct 23 2022 0 Bills - 000 Total. The Assessors office is responsible for ensuring that all property identified in the Connecticut general statutes as being subject to local property taxation is appraised at its market value as. Waterbury Ct 06705 currently has 29 tax liens available as of September 3.

Revenue Bill Search Pay - City Of Waterbury CT. When you give Liberty Tax the honor of preparing your taxes youre choosing to work with dedicated tax professionals wholl help get. 60 Day Redemption Active.

View download and print forms from our Forms Page. Active sale listings in Waterbury. Go inside The Waterbury to.

Once considered the Brass Capital of the World Waterbury remains a region full of talent and ambition an accepting community that welcomes your inclusion. You may also call 1-800-382-9463 Connecticut calls outside the Greater Hartford calling area only and select. If you have delinquent motor vehicle taxes please be aware that DMV clearances are now only.

Line 2 Individual Use Tax - If you made purchases online or out-of-state and did not pay sales tax you may owe CT use tax. To calculate the property tax multiply the assessment of the property by the mill rate and. Waterbury Ct 06706 currently has 17 tax liens available as of June 5.

View Cart Checkout. Failure to have received a bill does not exempt the taxpayer from payment of all taxes and all interest. It may take an additional 24 to 48 hours for DMV to clear you after your.

353 E Main St. Do I owe taxes. IRS Tax Debt Relief and Tax Resolution - Tax Liens Tax Collections IRS Audit Tax Appeal Unfiled Returns.

Waterbury ct taxes owed Friday October 21 2022 Edit.

Philip H Monagan Waterbury Ct Law Firm Lawyers Com

/https://s3.amazonaws.com/lmbucket0/media/business/brass-mills-mall-4893-1-qBCXOldc1F97rOd0f6Q9Q1WNEzdNJDkwburGzBzyNus.fadf5f97ff05.jpg)

Tablets At T Mobile Brass Mills Mall In Waterbury Ct

The Cap On Ct Car Taxes Lowers On July 1 Here S What To Know

Restaurant Empire Fading Away Republican American Archives

Waterbury Ct Recently Sold Homes 4 205 Homes Sold Properties Movoto

Used 2016 Jeep Grand Cherokee For Sale In Waterbury Ct Cars Com

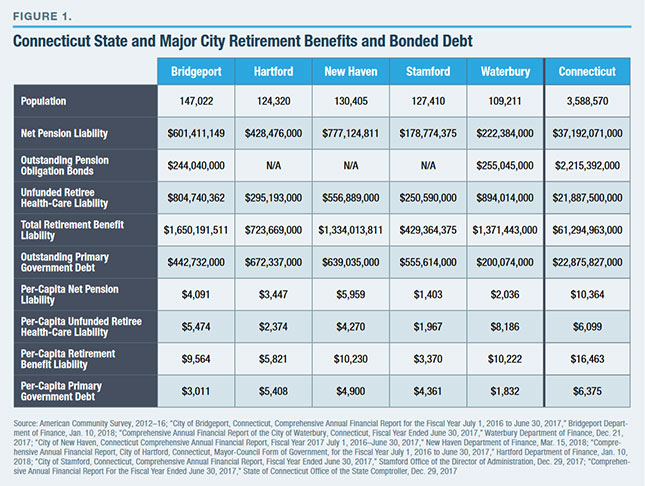

Connecticut City Pensions The Affordability Gap Ct Pension Reform

Debt Settlement Lawyer Waterbury Ct Law Offices Of Ronald I Chorces

Top 10 Best Title Loans In Waterbury Ct Last Updated October 2022 Yelp

Those Of You Who Have Been There Please Tell Us Some Stories From Holy Land In Waterbury Ct It Closed When I Was A Baby But I M Obsessed With Visiting The Site

Financial Problems Lead To Popular Waterbury Italian Deli Closing Republican American Archives

City Of Waterbury Ct Parking Tickets Payment System

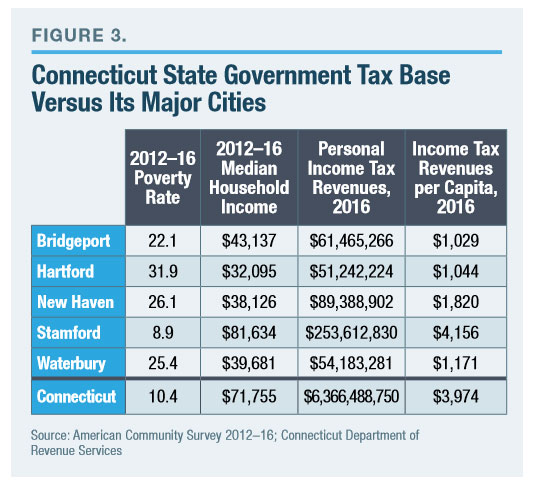

Connecticut City Pensions The Affordability Gap Ct Pension Reform